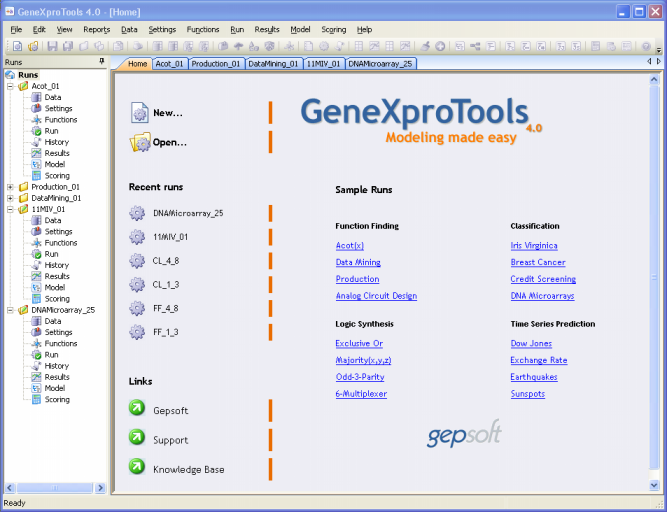

| GeneXproTools 4.0 ships with four different Sample

Runs for Time Series Prediction: Dow Jones,

Exchange Rate, Earthquakes,

and Sunspots. To try any one of them, you just have to click

its link on the Welcome Screen of GeneXproTools.

All these four sample runs use real-world data and you will see

that, like with all complex phenomena, it takes some cunning to

design very good models: some times good results can be obtained

using raw data, but other times by smoothing the data you can obtain

better results. In three of the sample runs (Dow

Jones, Exchange Rate, and Earthquakes)

an integral smoothing algorithm was used, and if you compare both

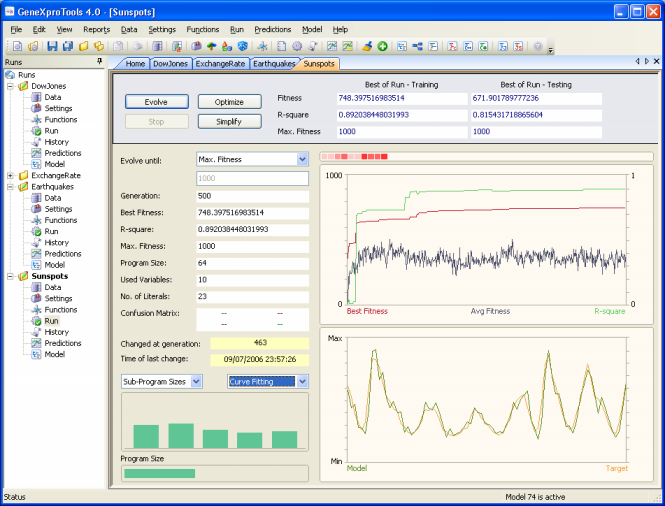

the plots and behavior of these time series with the Sunspots

series (in this case, the original raw data was used), you will see

that, as a rule, it is much easier to create good models using

smoothed data.

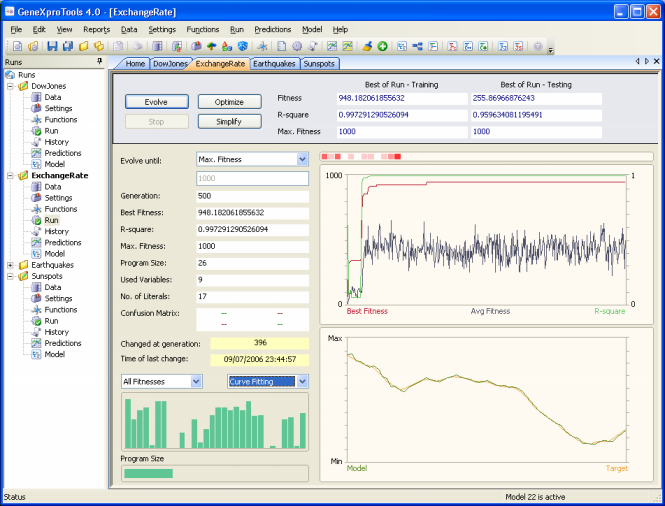

The Exchange Rate sample run uses the monthly average exchange rate of Australian dollar for US dollar. For this sample run, each value from the original raw time series (data file usexchm.dat obtained from the Time Series Data Library) was replaced by its moving average using a smoothing period p = 12. You will see that GeneXproTools is able to make very good predictions about exchange rates if you choose Testing Mode and then compare past known behavior with your models' predictions in the Predictions Panel.

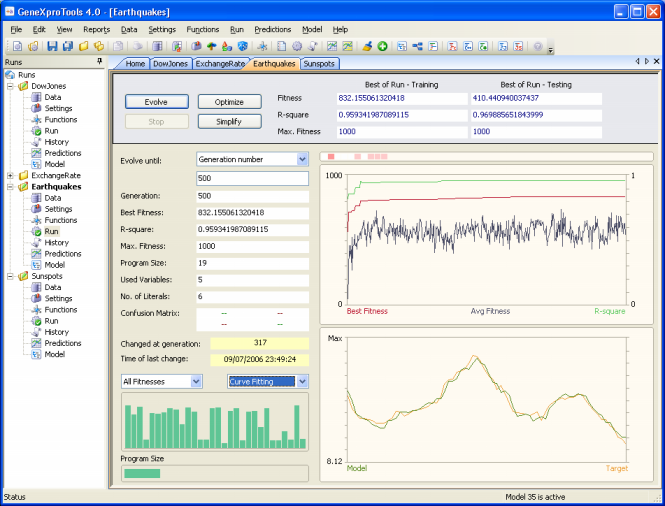

In the Earthquakes sample run a time series with the number of earthquakes per year with magnitude 7.0 or greater in the period 1900-1998 is used. And again, each value from the original raw time series (data file earthq.dat obtained from the Time Series Data Library) was replaced by its moving average using a smoothing period p = 10. You will see that GeneXproTools is able to make very good predictions about earthquakes if you choose Testing Mode and then compare past known behavior with your models' predictions in the Predictions Panel.

The Sunspots sample run uses the well-known Wolfer sunspots data. For this sample run, 100 observations of the Wolfer sunspots series were used with an embedding dimension of 10 and a delay time of one. You will see that GeneXproTools is able to make very good predictions about sunspots if you choose Testing Mode and then compare past known behavior with your models' predictions in the Predictions Panel.

|